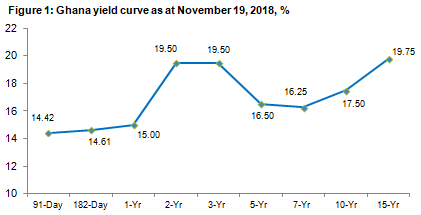

Short-term yields posted a mixed performance following 30bps drop in inflation to 9.5% in October 2018, which was contrary to investor expectations of higher inflation. The yield on the 91-day TB hardened by 1bps to 14.42% this week versus 14.41% last week whilst that of the 182-day TB softened by 3bps to 14.61% this week versus 14.64% last week. The yield on the 1-year note remained unchanged at 15.00% this week. See the current yield curve of the Ghanaian economy in figure 1 below.

The government was able to raise more than its target amount for the first time in several weeks due to strong demand for the 91-day TB. A total of GHS674.40mn was raised versus a target of GHS572.00mn for the week. Contrary to higher inflation expectations, inflation has dropped for two consecutive months from 9.9% in August to 9.8% in September and to a five-and-a-half-year low of 9.5% in October. The consistent drop in inflation is likely to drive a mixed performance of short-term yields (up in one week, down in another, and vice versa) in the coming weeks. See market activity charts for this week below.

Overall government borrowing from the domestic market has slowed in 2018 as government aims to reduce the fiscal deficit in 2018, buoyed by the recalculation of GDP, introduction of new tax measures to boost revenue generation, implementation of smart ideas that result in off balance sheet spending and cut in expenditure in the worst case scenario. However, there could be increased spending (and perhaps borrowing) in 2019 as the Akufo-Addo administration aims to ramp up infrastructure development and increase funding to flagship programs that formed the bedrock of campaign promises, and this could lead to potential fiscal slippages in 2019. See market activity charts for year-to-date below.

Source: Doobia